It’s hard to be looking for a home and not be exposed to the fact that interest rates are higher than they have been for decades. The vast majority of headlines around “home affordability” involve interest rates…either as a direct comparison of your diminished buying power or as a corollary to the “lock up” effect on existing homeowners. Both those effects ARE real. Higher rates mean higher payments on the same priced house or a decreased home purchase price. Similarly, the “lock up” effect, where existing homeowners are reluctant to swap their COVID-era interest rates for rates that are in some cases more than double, is, in fact, reducing housing inventory which typically contributes to rising prices.

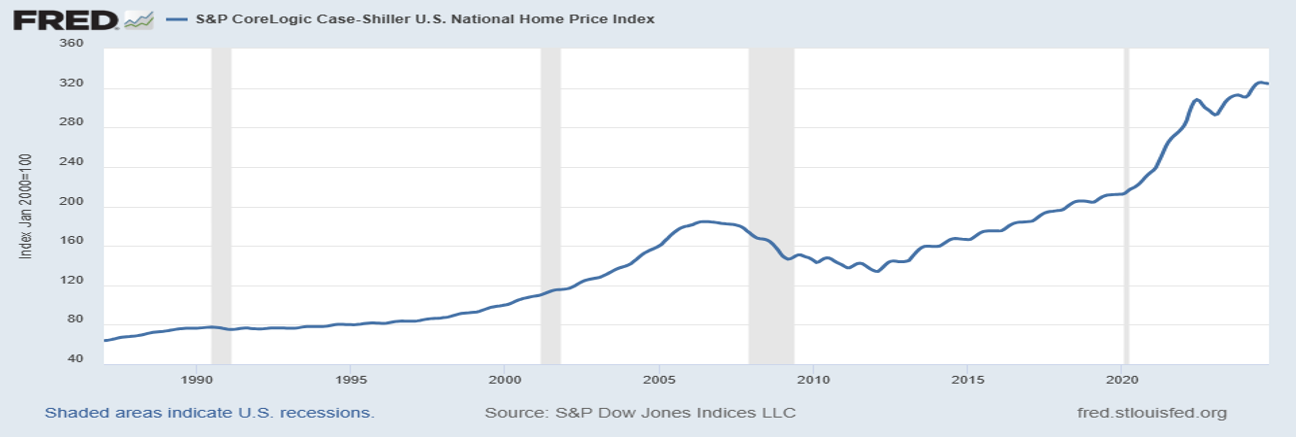

But the REAL story, the REAL reason housing is feeling more expensive is deceptively simple. Housing is more expensive in terms relative to income. This is demonstrated very clearly in a Nobel Prize winning piece of economic research that resulted in the Case-Shiller Index. Economists Case and Shiller looked at data associated both with the United States over all and more specific areas through a basket of key metropolitan areas. They compared the median income with median home prices across the country and in those target metro regions over time. Since their research was done in 1990 they set the index at 100 for the year 1990. That means that over time, they could compare future (and past) data from a common point of reference.

So, what has happened to that index over time? Well, as of the latest report, the Case-Shiller index is now over 340. That means that it now takes more than THREE times more of the median income to purchase the median home. In other words, incomes have not kept up with housing prices. There are several reasons for that, including government policies that favor home ownership, changing expectations of renting versus buying, and a few others. But none of that really matters here.

What does that mean for a perspective home buyer? Well, if that home buyer does nothing but read headlines (interest rates), they may feel encouraged to wait for rates to drop. But what happens while they are waiting? Home prices continue to rise. This is especially true in growing areas like the Tennessee Valley.

Let’s put numbers to that.

Say you are considering a $400,000 home. With today’s rates hovering around 7%, you be looking at a monthly payment of $2924.00. That feels too high, so you decide to wait for rates to come down. Over the next 12 months, rates bounce around and ultimately get to your target rate of 6%. So, you look to go buy that $400,000 at a 6% rate, figuring your payment would be lower. And, on a $400,000 house at 6% it is, coming in at $2,667. You saved almost $300 with your patience! Great, right?

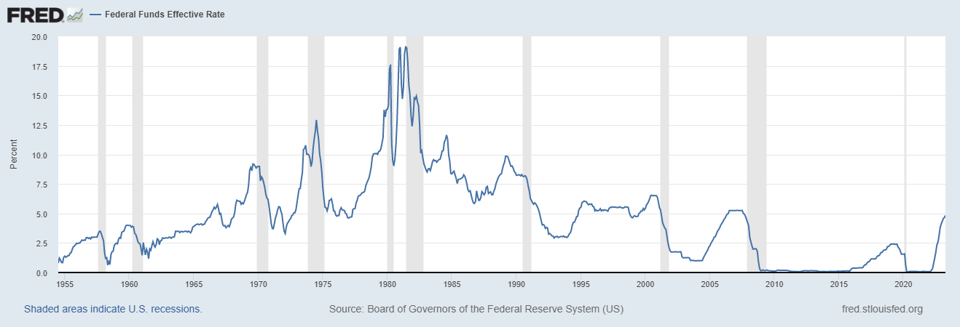

Well, not really. Because in that 12 months while you waited for rates to drop, that $400,000 home appreciated to $414,000. Now, your $414,000 at 6% has a monthly payment of $2761. Ok, you’re still ahead on a monthly basis, right? Yes, but saving that $163/month savings cost you $14,000 in equity. And, you’ve either been renting for a year or living in a home that is less than ideal. Finally, this assumes that waiting for rates to go down actually works…that rates actually do come down. Looking at the interest rates since 1990 right next to the Case-Shiller index over that same time, the more predictable is clearly the Case-Shiller. And the trend is overwhelming upward.

Interest Rates (Fed Funds) 1990 -2025

Case-Shiller Index 1990 – 2025

The message and tactics are clear. Don’t ignore the headlines. Interest rate impacts are real. But recognize that there is more to the story. Home prices, relative to income, are more than THREE times higher than they were in 1990. That trend doesn’t seem to be diminishing. Get what you can afford when you want to buy. If rates go down, refinance.

What to learn more? Drop us a note: